Bonus Depreciation On Farm Buildings . Web starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024, etc. Businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after. 100% bonus depreciation through 2022 80% bonus depreciation for 2023, less after 2023. Bonus depreciation percentage has been increased from 50% to 100% for qualified property. Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus. Certain longer term assets (that.

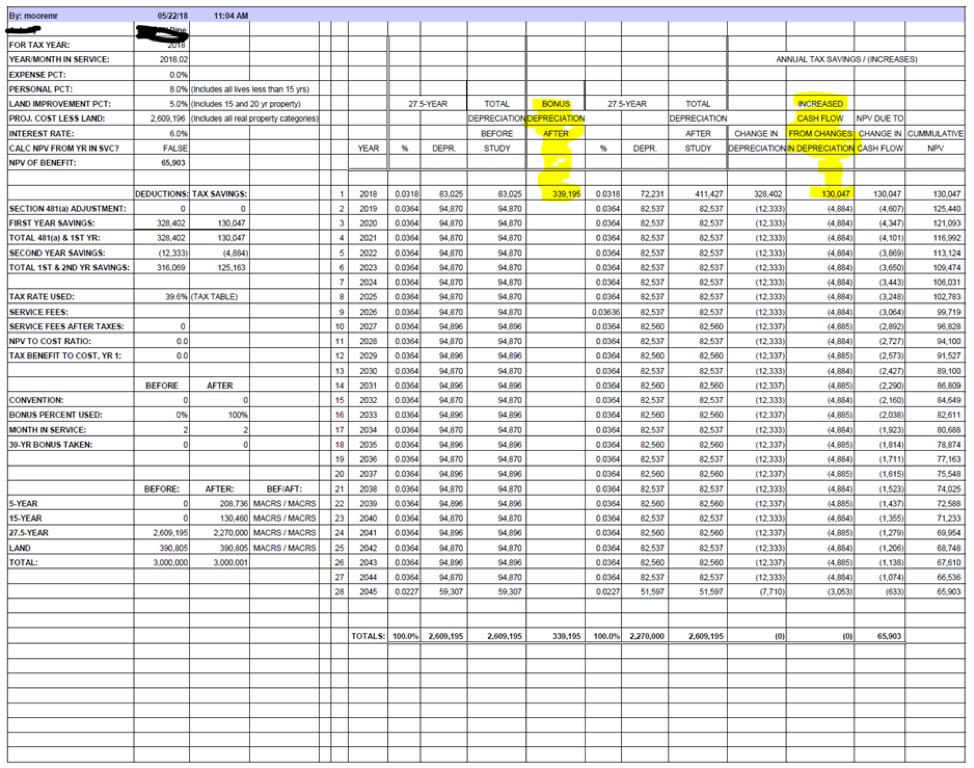

from simplepassivecashflow.com

Bonus depreciation percentage has been increased from 50% to 100% for qualified property. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus. Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm. Businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after. 100% bonus depreciation through 2022 80% bonus depreciation for 2023, less after 2023. Web starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024, etc. Certain longer term assets (that. Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition.

Cost Segregation & Bonus Depreciation Simple Passive Cashfow

Bonus Depreciation On Farm Buildings Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus. 100% bonus depreciation through 2022 80% bonus depreciation for 2023, less after 2023. Bonus depreciation percentage has been increased from 50% to 100% for qualified property. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus. Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm. Businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after. Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. Web starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024, etc. Certain longer term assets (that.

From brookenella.blogspot.com

Irs vehicle depreciation calculator BrookeNella Bonus Depreciation On Farm Buildings Web starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024, etc. 100% bonus depreciation through 2022 80% bonus depreciation for 2023, less after 2023. Businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after. Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179. Bonus Depreciation On Farm Buildings.

From www.chegg.com

TABLE 113 MACRS Depreciation for Personal Property Bonus Depreciation On Farm Buildings Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. Bonus depreciation percentage has been increased from 50% to 100% for qualified property. Certain longer term assets (that. 100% bonus depreciation through 2022 80% bonus depreciation for 2023, less after 2023. Farmers should accelerate purchases of qualifying assets. Bonus Depreciation On Farm Buildings.

From quintinpraise.blogspot.com

Depreciation recapture calculator rental property QuintinPraise Bonus Depreciation On Farm Buildings Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus. Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm. Certain longer term. Bonus Depreciation On Farm Buildings.

From www.calt.iastate.edu

Line 14 Depreciation and Section 179 Expense Center for Bonus Depreciation On Farm Buildings Certain longer term assets (that. Businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after. Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm. Web starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024, etc.. Bonus Depreciation On Farm Buildings.

From marieannwsydel.pages.dev

Illinois Bonus Depreciation 2024 Effie Halette Bonus Depreciation On Farm Buildings Certain longer term assets (that. Businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after. Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. 100% bonus depreciation through 2022 80% bonus depreciation for 2023, less after 2023. Web using bonus depreciation. Bonus Depreciation On Farm Buildings.

From www.youtube.com

Navigating New Depreciation Rules To Avoid Surprises for Farm Taxpayers Bonus Depreciation On Farm Buildings Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus. Businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after. Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm. Certain longer term assets (that. Bonus depreciation percentage has. Bonus Depreciation On Farm Buildings.

From www.farm-equipment.com

How Special Depreciation Rules Impact Farm Equipment Purchases Bonus Depreciation On Farm Buildings Bonus depreciation percentage has been increased from 50% to 100% for qualified property. Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. Web starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024, etc. Certain longer term assets (that. 100% bonus depreciation. Bonus Depreciation On Farm Buildings.

From simplepassivecashflow.com

Cost Segregation & Bonus Depreciation Simple Passive Cashflow Bonus Depreciation On Farm Buildings Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm. Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. Web starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024,. Bonus Depreciation On Farm Buildings.

From templates.rjuuc.edu.np

Depreciation Schedule Excel Template Bonus Depreciation On Farm Buildings Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm. Bonus depreciation percentage has been increased from 50% to 100% for qualified property. Certain longer term. Bonus Depreciation On Farm Buildings.

From lakeishaaliha.blogspot.com

Farm equipment depreciation calculator LakeishaAliha Bonus Depreciation On Farm Buildings 100% bonus depreciation through 2022 80% bonus depreciation for 2023, less after 2023. Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm. Farmers should accelerate. Bonus Depreciation On Farm Buildings.

From simplepassivecashflow.com

Cost Segregation & Bonus Depreciation Simple Passive Cashfow Bonus Depreciation On Farm Buildings Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus. Bonus depreciation percentage has been increased from 50% to 100% for qualified property. Businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after. Certain longer term assets (that. Web starting in 2023, 100% bonus depreciation will drop to 80% and then. Bonus Depreciation On Farm Buildings.

From www.buildium.com

Bonus Depreciation Saves Property Managers Money Buildium Bonus Depreciation On Farm Buildings Web starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024, etc. Certain longer term assets (that. Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus. Web using bonus. Bonus Depreciation On Farm Buildings.

From ardeliswfedora.pages.dev

2024 Bonus Depreciation Percentage Calculator Selle Danielle Bonus Depreciation On Farm Buildings Businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after. Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm. Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition.. Bonus Depreciation On Farm Buildings.

From financialfalconet.com

How to calculate bonus depreciation Financial Bonus Depreciation On Farm Buildings Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm. 100% bonus depreciation through 2022 80% bonus depreciation for 2023, less after 2023. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus. Bonus depreciation percentage has been increased from 50% to 100% for qualified. Bonus Depreciation On Farm Buildings.

From myexceltemplates.com

Asset Depreciation Schedule Calculator Template Bonus Depreciation On Farm Buildings Businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after. Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm.. Bonus Depreciation On Farm Buildings.

From www.calt.iastate.edu

Depreciating Farm Property with a FiveYear Recovery Period Center Bonus Depreciation On Farm Buildings Web using bonus depreciation [irc §168(k)] or the “expense election” under irc section 179 (both discussed in separate articles) can reduce farm. Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. Bonus depreciation percentage has been increased from 50% to 100% for qualified property. Web starting in. Bonus Depreciation On Farm Buildings.

From printablelibfester.z13.web.core.windows.net

Depreciation Excel Sheet Download Bonus Depreciation On Farm Buildings Bonus depreciation percentage has been increased from 50% to 100% for qualified property. Certain longer term assets (that. Web starting in 2023, 100% bonus depreciation will drop to 80% and then 60% in 2024, etc. Farmers should accelerate purchases of qualifying assets to maximize the benefits of bonus. Web using bonus depreciation [irc §168(k)] or the “expense election” under irc. Bonus Depreciation On Farm Buildings.

From www.chegg.com

On the tab marked 'Depreciation Schedule' complete Bonus Depreciation On Farm Buildings Businesses may take 100% bonus depreciation on qualified property both acquired and placed in service after. Web the bonus depreciation deduction, which is available for new and used property (under tcja) property, applies to farm buildings, in addition. Certain longer term assets (that. 100% bonus depreciation through 2022 80% bonus depreciation for 2023, less after 2023. Bonus depreciation percentage has. Bonus Depreciation On Farm Buildings.